Relocation loans can provide financial relief during a move, especially when unexpected

expenses arise. Moving to a new home, particularly over a long distance, often comes with

significant costs, including hiring movers, setting up utilities, and travel expenses.

Understanding how relocation loans work, their benefits, and potential downsides can help you

decide if they are worth it, considering your situation.

What Are Relocation Loans?

Relocation loans are personal loans designed to cover the costs of moving. These loans can be

used for a variety of expenses, such as hiring professional movers, renting a truck, or even

temporary housing. They are typically unsecured loans, meaning you don’t need to put up

collateral like your home or car to qualify. Rather, lenders use your income, financial history,

and credit score to determine your creditworthiness.

How Do Relocation Loans Work?

The lender will examine your application when you apply for a relocation loan to see whether

you are eligible. After approval, the lender gives you a lump sum payment that you pay back

over a certain length of time in fixed monthly installments. The interest rate and repayment

terms depend on many different factors, such as the lender’s policies or your credit score. While

some loans have flexible payback schedules, others have a few months’ due deadline.

Who Should Consider a Relocation Loan?

Relocation loans are suitable for individuals who need immediate financial assistance to cover

moving expenses. These loans can be particularly helpful if you’re relocating for a new job.

Some employers offer relocation assistance, but not all companies cover the full cost of a move.

In such cases, a loan can bridge the gap.

Additionally, people moving long distances or those with unexpected expenses, like storage

fees or repairs to their current home, might benefit from a relocation loan. However, assessing

your ability to repay the loan is essential before committing to it.

Benefits of Relocation Loans

One of the main advantages of relocation loans is their flexibility. You can use the funds for

various purposes, making them an adaptable financial tool. Relocation loans can feature lower

interest rates than credit cards, particularly if your credit is good.

These loans also provide immediate access to funds, allowing you to tackle moving costs

without depleting your savings. The fixed repayment schedule makes it easier to budget for

monthly payments, ensuring you stay on track financially.

Potential Drawbacks of Relocation Loans

While relocation loans can be helpful, they also come with risks. The interest rates may be high

for individuals with poor credit, leading to costly repayments. Taking on debt without a clear repayment plan can strain your finances, especially if you encounter unexpected challenges

during your move.

Another consideration is the loan fees. Some lenders charge origination fees, which can

increase the overall cost of the loan. Carefully review the terms and conditions before signing to

ensure there are no hidden costs.

Alternatives to Relocation Loans

Before opting for a relocation loan, consider other funding options. Savings are the most

straightforward way to cover moving expenses, though this requires advanced planning.

Employer relocation packages can also alleviate financial stress, so inquire with your HR

department about available benefits.

If you have a good credit score, using a credit card with a 0% introductory APR may be an

alternative. This option allows you to spread payments over several months without accruing

interest as long as you pay off the balance within the promotional period.

How to Prepare Valuable Items for Long-Distance Relocation

Relocating valuable items requires careful preparation to ensure their safety during transit. Start

by creating an inventory of your valuables, documenting their condition with photos. Use sturdy,

padded packing materials and clearly labeled boxes to reduce the risk of damage.

Consider purchasing additional insurance through your moving company or a third-party

provider for particularly valuable or fragile items. If possible, transport smaller valuables, such

as jewelry and important documents, yourself. This ensures they remain within your control.

Remember, managing to keep your valuables secure during the move is crucial for peace of

mind. Use lockable storage containers for added protection, and avoid packing items with

sentimental or monetary value in the moving truck whenever possible. When considering how to

prepare valuable items for a long distance relocation, plan ahead to ensure they are packed and

transported with extra care.

Steps to Apply for a Relocation Loan

Applying for a relocation loan involves several steps. First, assess your financial needs and

determine how much you’ll need to borrow. Research lenders to find one offering competitive

interest rates and favorable terms. Online reviews and customer feedback can provide insights

into the lender’s reliability.

Once you’ve chosen a lender, gather the required documents, such as proof of income,

identification, and details about your expenses. Submit your application online or in person,

depending on the lender’s process. After approval, review the loan agreement carefully before

accepting the terms.

Tips for Managing Relocation Loan Repayments

Managing your loan repayments is essential to avoid financial stress after your move. Start by

incorporating the monthly payment into your budget. Set reminders to make payments on time,

as late fees can increase your overall cost.

To save interest money, consider paying off the loan early if your financial circumstances

improve. However, check if your lender charges prepayment penalties. Maintaining open

communication with your lender can also be beneficial if you make payments difficult.

Is a Relocation Loan Worth It?

Deciding whether a relocation loan is worth it depends on your financial situation and the

specifics of your move. For people with little money or high moving costs, these loans might

offer much-needed help. However, the potential risks, such as high interest rates and fees, must

be carefully weighed against the benefits.

If you have run out of alternative funding choices and are certain that you can repay the loan, a

relocation loan may be a useful tool. On the other hand, if taking on debt feels overwhelming, it

might be better to explore alternative solutions.

Conclusion

Relocation loans can ease the financial burden of moving, offering flexibility and immediate

access to funds. However, they also come with potential drawbacks, including high interest

rates and fees. You can determine if a relocation loan is worth it by carefully evaluating your

needs and exploring all available options. Before committing, ensure you have a clear

repayment plan and consider how the loan aligns with your long-term financial goals. Whether

you decide to apply or pursue alternative funding, thorough preparation and budgeting will make

your relocation smoother and less stressful.

More Stories

One Dead, Two Injured in Shooting Near ASU Campus

ICC Judges amend the Regulations of the Court to regulate motions for acquittal

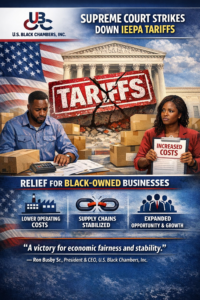

U.S. Black Chambers, Inc. Statement on Supreme Court Decision Invalidating Tariffs Imposed Under IEEPA